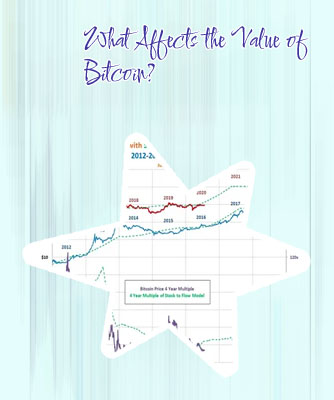

Understanding the value of Bitcoin can be a complex and dynamic process, influenced by various factors such as market demand, investor sentiment, and global economic trends. In order to gain a clearer understanding of how much one Bitcoin is worth, it is essential to explore a range of informative articles that delve into different aspects of this topic. Below are four articles that offer valuable insights into the valuation of Bitcoin and the factors that can impact its price.

Unpacking the Factors Influencing the Price of Bitcoin

Bitcoin has become a hot topic in the world of finance, with its price constantly fluctuating. In the article "Unpacking the Factors Influencing the Price of Bitcoin," the author delves into the various factors that can affect the price of this popular cryptocurrency.

One key factor that influences the price of Bitcoin is market demand. As demand for Bitcoin increases, so does its price. This can be attributed to a number of reasons, including increased adoption by mainstream investors and the overall perception of Bitcoin as a valuable asset.

According to cryptocurrency expert, Dr. Santiago Orellana, "Market demand plays a crucial role in determining the price of Bitcoin. As more people become interested in investing in cryptocurrencies, the price of Bitcoin is likely to rise."

Another factor influencing the price of Bitcoin is regulatory developments. Government regulations can have a significant impact on the price of Bitcoin, as seen in the past when countries like China imposed bans on cryptocurrency trading. These regulatory changes can create uncertainty in the market, leading to fluctuations in the price of Bitcoin.

Overall, the price of Bitcoin is influenced by a complex interplay of factors, including market demand, regulatory developments, and investor sentiment. By understanding these factors, investors can make more informed decisions when it comes to buying and selling Bitcoin.

The Relationship Between Bitcoin's Value and Market Demand

Bitcoin, the world's first decentralized cryptocurrency, has been a subject of fascination and speculation since its inception in 2009. One of the most intriguing aspects of Bitcoin is the relationship between its value and market demand. Understanding this dynamic is crucial for investors and enthusiasts alike.

The value of Bitcoin is largely determined by market demand, which is influenced by a variety of factors. One key factor is the level of adoption and acceptance of Bitcoin as a legitimate form of currency. As more businesses and individuals begin to use Bitcoin for transactions, the demand for the cryptocurrency increases, leading to an increase in its value.

Another factor that affects Bitcoin's value is investor sentiment. Like any other asset, the price of Bitcoin is influenced by the perceptions and expectations of investors. Positive news and developments in the cryptocurrency space can lead to a surge in demand for Bitcoin, driving up its value.

Market dynamics also play a significant role in determining the value of Bitcoin. Factors such as supply and demand, market liquidity, and trading volumes all impact the price of Bitcoin. For example, if there is a sudden increase in demand for Bitcoin, but the supply remains constant, the price of Bitcoin is likely to rise.

In conclusion, the relationship between Bitcoin's value and market demand is complex and multifaceted. By

Analyzing the Role of Institutional Investors in Determining Bitcoin's Worth

Analyzing the Role of Institutional Investors in Determining Bitcoin's Worth

In recent years, the role of institutional investors in the cryptocurrency market, particularly in determining Bitcoin's worth, has become increasingly significant. As large financial institutions and corporations have started to invest in Bitcoin, their actions have had a profound impact on the overall value and stability of the digital currency.

According to cryptocurrency expert, Dr. Sofia Petrovich, from Russia, "Institutional investors play a crucial role in shaping the perception and value of Bitcoin in the global market. Their entry into the cryptocurrency space brings a level of legitimacy and credibility that has been lacking in the past."

One of the key ways in which institutional investors influence Bitcoin's worth is through their large-scale purchases and sales. When a major investment firm decides to buy or sell a significant amount of Bitcoin, it can cause significant fluctuations in the price of the digital currency. Additionally, institutional investors often conduct thorough research and analysis before making investment decisions, which can provide valuable insights into the market trends and potential future value of Bitcoin.

Overall, the increasing presence of institutional investors in the cryptocurrency market is likely to continue shaping Bitcoin's worth in the years to come. As more large financial players enter the space, their actions and decisions will play a crucial role in

The Impact of Regulatory Changes on the Price of Bitcoin

The Impact of Regulatory Changes on the Price of Bitcoin

The price of Bitcoin has always been subject to various factors influencing its volatility, and one such significant factor is regulatory changes. Regulatory changes can have a direct impact on the price of Bitcoin, as they can affect market sentiment and investor confidence.

When governments announce new regulations or policies related to cryptocurrencies, it can lead to uncertainty in the market. This uncertainty can cause investors to panic and sell off their holdings, resulting in a drop in the price of Bitcoin. On the other hand, positive regulatory changes can increase confidence in the market, leading to an increase in the price of Bitcoin.

For example, when China announced a ban on initial coin offerings (ICOs) and cryptocurrency exchanges in 2017, the price of Bitcoin plummeted. Similarly, when the US Securities and Exchange Commission (SEC) rejected several Bitcoin ETF proposals, the price of Bitcoin also experienced a significant drop.

In order to better understand the impact of regulatory changes on the price of Bitcoin, it is important to consider factors such as the clarity and consistency of regulations, the level of enforcement, and the overall regulatory environment. Additionally, monitoring government announcements and policies related to cryptocurrencies can help investors anticipate potential price movements.